Sin Chew Daily

On October 3, the International Consortium of Investigative Journalists (ICIJ) released the Pandora Papers, the largest ever exposé of untold financial secrets covering over 200 countries and territories across the planet and involving 11.9 million confidential documents which unearth the secretive deals of the rich and famous and how their wealth has been hidden in offshore accounts.

The names of several Malaysian politicians and entrepreneurs have been mentioned in the papers, including finance minister Tengku Zafrul, Umno president Ahmad Zahid Hamidi, former finance minister Daim Zainuddin and PKR MP William Leong.

Seeing the seriousness of this matter, the opposition Pakatan Harapan and several NGOs have called on the government to look into it as it entails suspected irregularities on the part of the relevant authorities in overseeing capital outflow.

Opposition Leader Anwar Ibrahim has submitted a motion under the parliamentary Standing Order for a debate on the Pandora Papers, but the same has been thrice rejected by the Speaker. Other opposition lawmakers have also raised the issue in Dewan Rakyat, calling for a debate and investigation by Bank Negara and the Securities Commission but to no avail.

Politicians named in the papers have squarely denied their involvement by producing all kinds of evidences and arguments to dismiss the authenticity of the papers or non-updates of details, while questioning the motive behind such investigative reports.

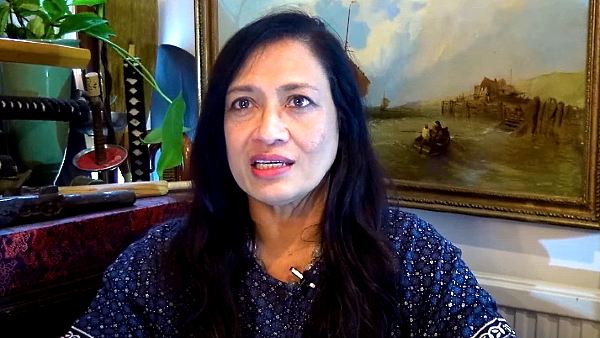

Tengku Zafrul said it was not surprising his name was mentioned, as he used to be a senior corporate leader. He said it is not against the law for Malaysians to maintain offshore bank accounts from the legal point of view, adding that any company flouting the law will be dealt with and ordered to close.

He also said any suspicious offshore account could be put under the surveillance of the authorities under the Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA).

The finance minister said it was inconceivable (tak masuk akal) for as much as RM900 billion of money to be siphoned out of the country. Anyway, he said he would discuss this matter with Bank Negara, IRB and other relevant agencies.

The revelation of such a massive financial secret is indeed shocking. It doesn’t matter how real the revelations are, the fact that several individuals have admitted indirect involvement and Tengku Zafrul’s confession that large consortia do operate offshore banks and companies which is not against the law nor a secret, then everything should go by the law!

The revelation of such a massive financial secret is indeed shocking. It doesn’t matter how real the revelations are, the fact that several individuals have admitted indirect involvement and Tengku Zafrul’s confession that large consortia do operate offshore banks and companies which is not against the law nor a secret, then everything should go by the law!

While such acts may not be unlawful, they nevertheless might implicate tax evasion or tax avoidance. Very often this is done as a money-laundering ploy to conceal some covert wealth.

If similar acts have been able to escape government actions in the past, it simply shows that the government outright lacks a strong political will to deal with such problems.

In view of this, local NGOs have urged the government to openly declare company assets in order to better supervise the structures of involved companies, their capital flow and any dummy setup, in a bid to stem illegal capital outflow.

Additionally, stricter laws must be enacted to mandate asset declaration by ministers, deputy ministers and elected representatives. This has been been discussed for some time now but is yet to be implemented.

The objective of the so-called Sunshine Act or Transparency Act is to mandate asset declaration by civil servants in a bid to check corruption and abuse of power. That said, the asset declaration directive has no legal binding and the MACC is not empowered to pursue under-declaration, fraudulent declaration or non-declaration of assets.

As such, there should be nothing to stop the debate of the Pandora Papers in Parliament!

Whenever someone has huge sums of money parked in an offshore institution, the issues of asset acquisition and remittance channel will surface. Such queries could be cleared through a parliamentary debate.

And since Tengku Zafrul has said such enormous sums of capital outflow do not look reasonable, then there is one more valid reason to clear the doubts!

Other than discussions among the relevant departments, such a matter ought to be discussed openly and fairly in Parliament.

By the way, why not face it if there’s nothing to hide?

ADVERTISEMENT

ADVERTISEMENT